2021-08-11

Vietnam and Thailand represent some of the most interesting and attractive countries in Asia to invest in real estate. Their booming economy and population growth as well as their cheap labor has attracted many companies and investors that wish to take advantage of one of 2018 best opportunities. The capital gain and rental yield alone make these countries a must invest for anyone out there looking to increase their fortune with real estate.

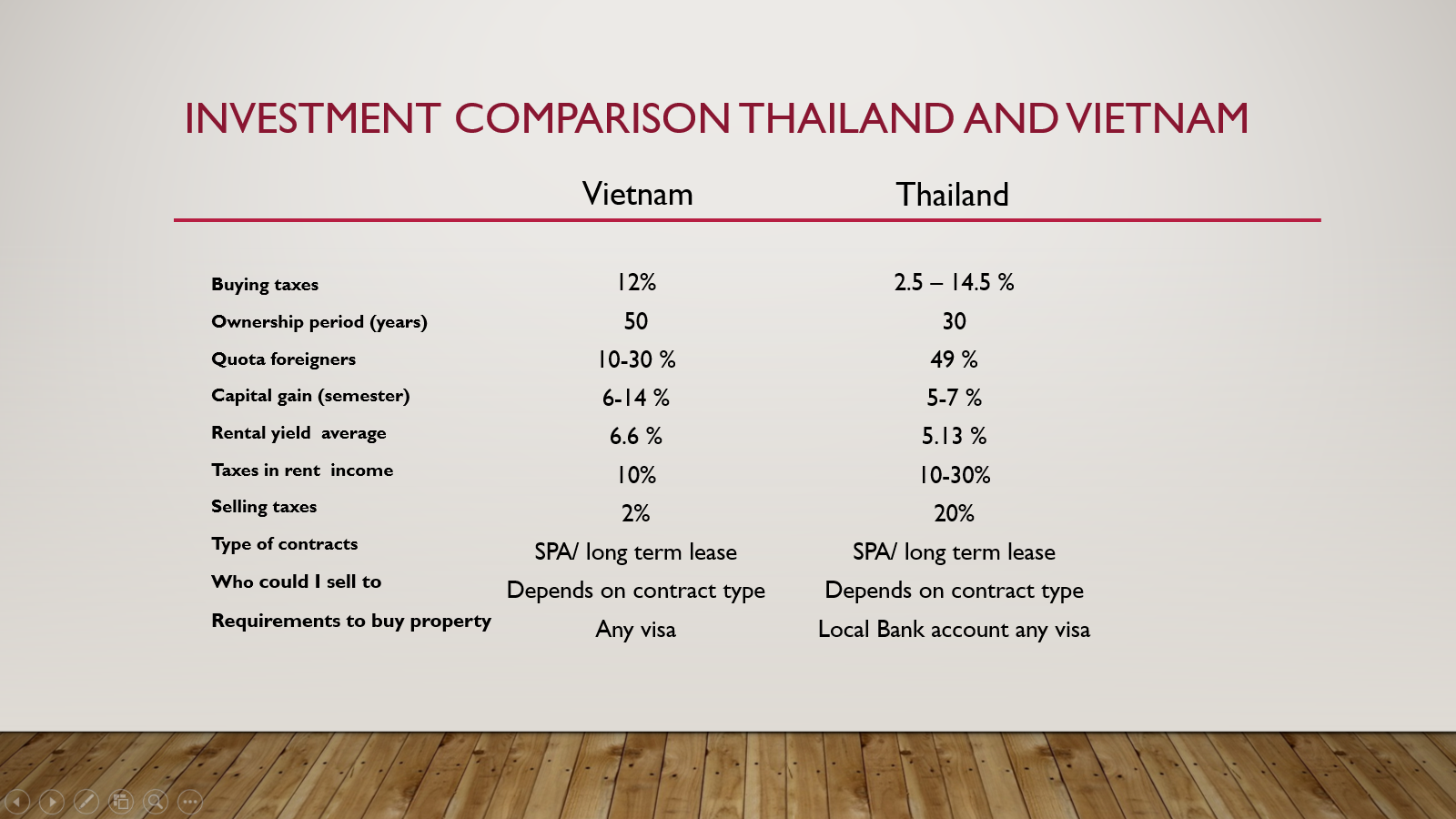

Taxes:

If we analyze taxes as a whole the most beneficial country to invest would be Vietnam, not only it has lower taxes when buying property but also the taxes over sales and rental income are more beneficial to foreigner investors. In Thailand entry taxes can be 2.5% if this land would be treated as a gift or if your planning to live there, but as a foreigner investor we focus capital gain and rental yield; land with this purpose is subject to an additional 12% taxes which leaves entry taxes 2.5% higher in Thailand than in Vietnam. Rental yield taxes for Vietnam are some of the lowest in Asia and in other worldwide booming economies, at just 10% of the total rent is required for taxation purposes. This makes cities like Ho chi Minh and Hanoi one of the most attractive places to acquire properties.

Ownership opportunity:

Thailand has a mayor capacity for foreigners to obtain properties 49% of properties in condos can be owned by non-residents which is 19% more than the quota available in Vietnam, this may represent easier sales to non-locals. We must consider other factors which can help you decide where to buy your next property for instance in both countries you can’t actually buy the land but you can have the rights over the land for 30 years in Thailand and 50 years at Vietnam, renewal of documents must be done when the period is ending if not properly done the land rights would return to the country.

Property profit:

The property value in both markets increases steadily and buying in either market would represent an smart investment which will return profit in near future. The big difference is that the economy at Vietnam is passing through boost which makes investments in real estate have a faster and more profitable gain than Thailand. The average gain rises to a maximum of 14% and a minimum of 7% each semester, which is more profitable in short and long terms than Thailand. Also, rental yield is in an all-time high at Vietnam having a minimum of 6% return annually which is still above the average rent income at Thailand.

Contracts: SPA and Leasing

Contracts documentation behave the same in both countries since you cant have land to your name, but it is possible to get the property right for 30 years in Thailand and 50 at Vietnam. There are variations in Thailand contracts SPA gives you rights on the property as Vietnam does but there are variations in Leasing; Property Lease can divide in Usufructs will give you right over contractions done in the land ( rent applies) , Superficies can used land for any purpose , when the 30 years are over the land must be return in the same state as when sold, if the owner decides he wants to change the construction over the land the property ownership can’t be extended and I’ll be sold.

Foreign buying and selling properties:

The requirements needed to purchase properties in both countries are very simple and easy to fulfil for any party interested real estate. The state requires you to have a visa stamp in both countries something very basic that probably all investors will acquire when traveling to find the best location and property available. Thailand how ever has a second requirement and it is for you to have a local bank account, at Vietnam this is a suggestion but not a necessary field to complete for your new asset.

Selling properties is easy to be done in both countries, Vietnam has the upper hand due their no lawyer requirement two government agencies that help confirm a deal is legal and fair are involve in all SPA and long term leasing process. In Thailand a legal representative is necessary for property transfer process, The quota must be kept in both countries , Vietnam villas 10% foreign quota and 30% in apartments, Thailand 49% in all buildings. Taxes when selling and withdrawing your money from the country make a big difference to decide which country could be most beneficial for you, Keep in mind taxes paid at Vietnam when selling are only 2% while in Thailand 20%, this could be point that would help you make an inform decision today.

Both countries have advantages one over the other, but as a whole Vietnam represent a more attractive location for investors since entering and leaving the markets is simpler and more profitable. The conditions although favorable in both markets are stronger in Vietnam, making investments in Vietnam easier to manage and obtain capital than Vietnam.

Vietnam Office

Anna Nguyen

Anna Nguyen

0906930506

0906930506

admin@mdvnrealty.com

admin@mdvnrealty.com

Last News

0 Comment

Leave a Reply

Your email address will not be published. Required fields are marked *